- Home

- Buying a vacation house with equity

Buying a vacation house with equity

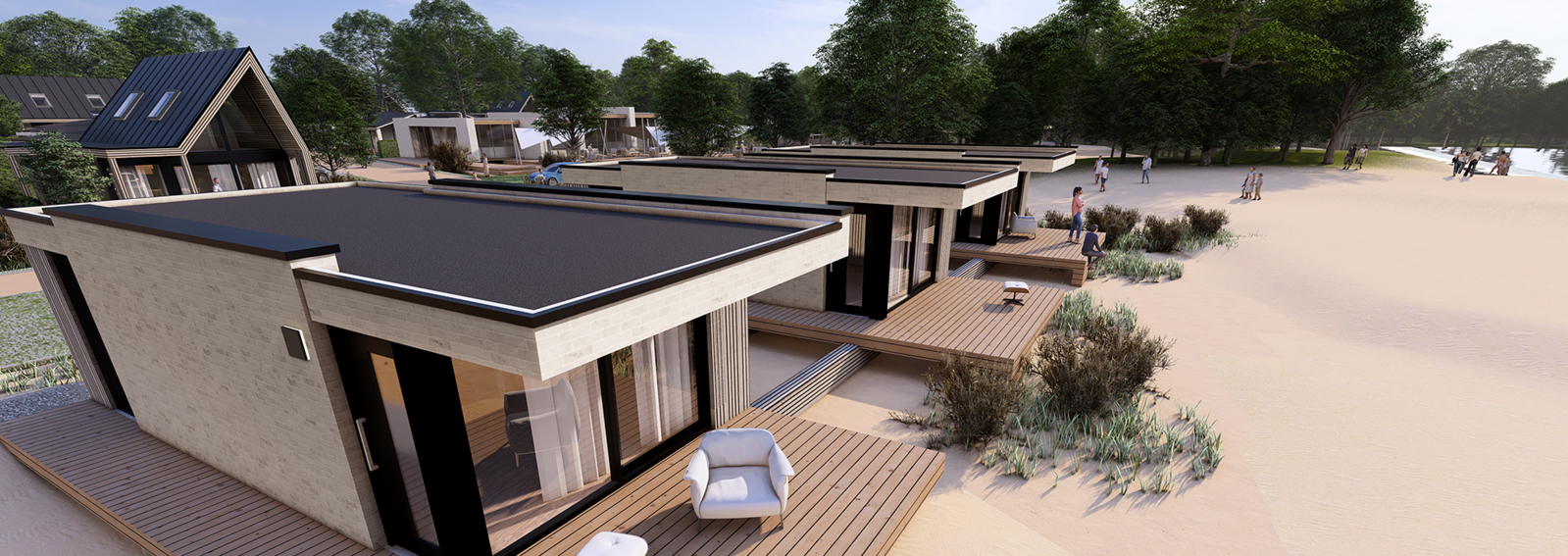

Do you have equity in your home? Then invest wisely in a vacation home and obtain a good return with HUB Resorts.

Have you noticed that the value of your home has increased over the past few years? This means that you may have built up equity. Equity is the difference between the current value of your home and the amount you still have to pay off on your mortgage. You can use this equity to invest in something new, such as a vacation home. But how exactly does that work, and why is it a smart investment?

What is equity and how can you use it?

If the value of your home has increased since you bought it, the equity may present a great opportunity. You can use this equity with a second mortgage or a bridging loan. This means that you do not necessarily have to sell your house to access this money. Many people use this option to invest in a vacation home.

Why a vacation home?

A vacation home can be an appealing investment for several reasons:

- Passive income through renting out: when you do not use the vacation home yourself, you can rent it out to tourists or vacationers. With platforms like Airbnb or specialized rental companies, you can generate a steady income, especially if your vacation home is located in a popular region.

- Value development: just like the value of your own home has increased, the value of a vacation home can also increase. This means you not only benefit from rental income but also from long-term value appreciation.

- Personal vacation spot: in addition to the financial benefits, there is also the personal added value. A vacation home offers your own spot to regularly escape from the daily hecticness. You can use the home for yourself, your family, or friends.

How do you do it?

- Get advice from a mortgage advisor: a mortgage advisor can help you explore the possibilities and calculate how much you can borrow based on the equity in your current home. You can often borrow up to 80% of the value of your current home, minus the outstanding mortgage debt.

- Take a look at the possibilities for renting out: find out in which areas there is a high demand for vacation homes. This can help you determine where you can best buy your vacation home. Think of popular tourist regions, but quiet nature areas can also be appealing for renting out.

The smart choice

Investing your equity in a vacation home is smart because it allows you to further grow your capital. You use the accumulated capital without using your own savings. You also benefit from an additional source of income and the potential increase in the value of the home. In times of low savings interest rates, it can be an interesting way to let your assets yield a return.

In short, with the equity in your home you can smartly invest in a vacation home and enjoy the benefits both financially and personally.

Interested in buying a vacation home at HUB Resorts?

Then schedule a callback request with our broker Herber Blokland. During this conversation, you will know within 15 minutes what the possibilities are for you as an owner!